By Roxy Caines, Get It Back Campaign Director, Center on Budget and Policy Priorities

Editor’s note: The novel coronavirus (COVID-19) has complicated tax season this year. To stay abreast of the latest guidance for filing taxes in 2020, visit the Center on Budget and Policy Priorities' COVID-19 Tax Resources page.

Tax season can evoke a range of emotions for people, from excitement to anxiety. Frequently, tax time is associated with a tax refund, which can represent the single largest lump sum many families receive in any given year. These refunds can provide a pathway to transition out of poverty and to build wealth.

Tax filing, however, is not a straight-forward process. Life occurrences and complex circumstances, including domestic violence, can pose obstacles that prevent some people from filing at all.

What Are Tax Filing Barriers for Survivors of Domestic Violence?

Below are five barriers that may prevent survivors of domestic violence from filing a tax return. They may be:

1. Afraid of making mistakes

Tax filing can be overwhelming and intimidating, especially if someone has never filed taxes before. Since Internal Revenue Service (IRS) language isn’t simple, people may not know what to do even after reading tax documents or filing instructions. Fear is a major obstacle to tax filing, even for those who have been filing their taxes for years. Many people are scared that if they make a mistake on their tax return, the IRS will “come after them.”

Advocates can help dispel tax filing myths and share accurate info with survivors. The Center on Budget and Policy Priorities’ Get It Back Campaign provides accessible resources on tax filing, tax credits, gig work taxes, and more. Advocates can let survivors know that the IRS will work with them to correct tax filing mistakes.

2. Missing tax documents

If a survivor has recently moved, their mail – including tax documents – may not automatically be forwarded to their new address. In cases when a survivor needs to flee quickly, important paperwork may get left behind. While it is still possible to file taxes with missing documents, the process to obtain or reconstruct documents takes additional time. (![]() See “Advocate Opportunities” for more details.)

See “Advocate Opportunities” for more details.)

Additionally, if a survivor was in a relationship where their abuser controlled the finances, they may not have access to financial information like bank accounts or be aware of everything in their name. Survivors may be unfamiliar with how their sources of income are documented and which tax forms they should receive.

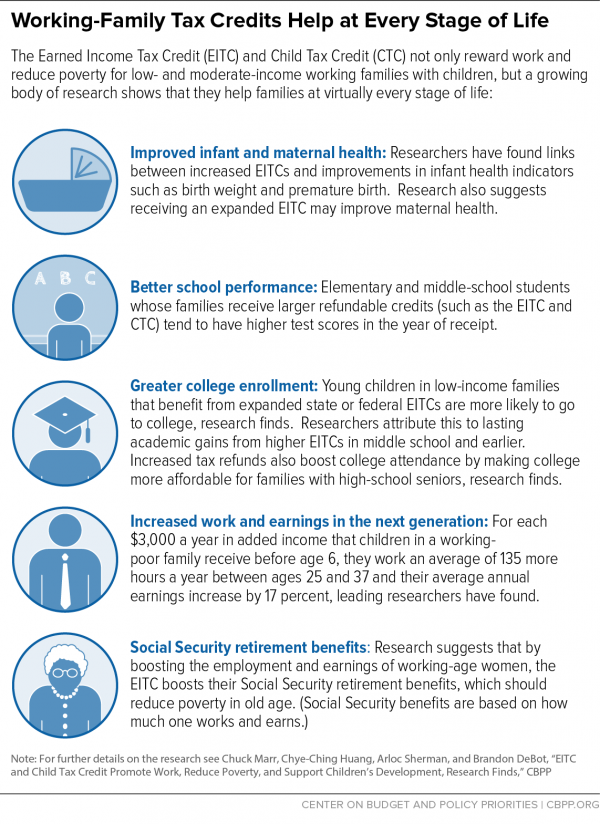

3. Unaware of tax filing benefits

Many people with earnings below the filing threshold are unaware of the benefit of filing a tax return. The possibility of getting money back as a tax refund is a primary reason to file a tax return, even for those who don’t owe taxes. Tax refunds provide flexibility and allow filers to prioritize their financial needs. For example, a tax refund can help cover school supplies, car repairs, medical expenses, or even a down payment on a home. Additionally, tax credit refunds like the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) can be claimed for up to three prior years if all eligibility requirements are met for the tax year being filed for.

Research shows that working family tax credits such as the EITC and the CTC play an important role in overcoming racial income disparities, especially benefiting women of color. For example, the EITC boosted the incomes of 9 million women of color in 2019. “That’s largely because people of color are far likelier than white people to work in low-paid occupations, work part-time or part-year instead of full-time and year-round, and have lower wages within a given occupation, trends that reflect both the legacy of severe discrimination and continued structural barriers to opportunity.”

4. Lacking a permanent (or private) mailing address

Safety and privacy are understandably primary concerns for survivors. Some survivors may mistakenly believe that a tax return is a public document and that a former abuser could access it to track down personal information, including a new address. Advocates can let survivors know that tax returns and return-related information are confidential and protected against unauthorized disclosure by the IRS.

Survivors who reside in a shelter or a temporary dwelling can file a tax return and claim tax credits even though they do not have a permanent address. Domestic violence shelters and other service providers (such as Community Action Agency or Salvation Army) may allow survivors to use their address for tax purposes. This is especially useful if a relative or friend’s address isn’t available or isn’t private.

5. Unaware of trustworthy and affordable tax help

5. Unaware of trustworthy and affordable tax help

Most people find it challenging to find a tax preparer who is well-trained, professional, and affordable. The importance of quality and trustworthy tax services cannot be underestimated.

Some paid tax preparers avoid disclosing their fee until the end of the session or discreetly subtract their service charge from the total tax refund. Since there are no national standards or regulation of the tax preparation industry, it’s easy for some paid tax preparers to take advantage of their clients. This can be especially harmful since tax filers, not preparers, are ultimately held responsible if there are errors or negligence associated with their tax return. Correcting this kind of damage can lead to wasted time and money, plus unnecessary stress.

In some cases, paid tax preparers may also offer “refund anticipation loans” with the promise of an immediate tax refund in exchange for a processing fee. Paid preparers often charge high interest rates for the loan, in addition to the processing fee. This predatory practice takes advantage of low-income families and individuals in dire need of a quick refund. Before entering a refund anticipation loan, it is critical to be aware of all the fees and interest rates, as well as the repayment terms.

Additionally, some tax preparers may not have an established confidentiality protocol that they follow. Fortunately, there are alternatives, including free tax filing services. Preparers in free tax programs are trained by the IRS and must follow confidentiality guidelines that prohibit disclosing a tax filer’s information to any other person or agency.

Advocates can help connect survivors to quality tax help. (![]() See “Advocate Opportunities” for more details.)

See “Advocate Opportunities” for more details.)

Helpful Tax Laws

Some tax rules may be particularly useful for domestic violence survivors, especially if they unknowingly become liable for financial matters. For example, a survivor may be forced to sign a document without full disclosure of what it is and how it will be used.

Here are seven aspects of the tax code that may help some survivors.

- Head of Household Filing Status to Claim the EITC - Allowed for a married tax filer who is separated and meets the following criteria:

- lived apart from their spouse for the last six months of the year,

- lived with the child for more than half the year, and

- paid more than half the cost of maintaining the household for the year and is eligible to claim the child as a qualifying child.

- Innocent Spouse Relief - Reduces or eliminates a spouse’s liability on a joint tax return in certain cases like if a spouse reported income improperly or claimed improper deductions or credits.

- Injured Spouse Relief - Releases a spouse from liability for certain past-due tax debt that is attributable to the other spouse.

- Equitable Relief - Divides tax liability based on the adjusted gross income of each spouse but does not clear either spouse of total liability.

- Separation of Liability - Divides unpaid tax liability based on ability to pay for spouses who are legally separated or no longer married.

- Reasonable Cause Relief - Provides clearance from the obligation to file a tax return or pay penalties if one can present compelling facts to show why they were unable to do so on time.

- Amended Tax Return - Corrects a previously submitted tax return or allows one to file for a missed year. Tax credits like the Earned Income Tax Credit or Child Tax Credit can be claimed for up to three previous years.

Keep in mind that tax documents from prior years are needed for some of these forms of tax relief. If the documents aren’t readily available, the process to get the records and apply for tax relief may be lengthy. (![]() See “Advocate Opportunities” for more details.)

See “Advocate Opportunities” for more details.)

Advocate Opportunities

Advocate Opportunities

Having a basic understanding of tax filing barriers allows advocates to better address survivors’ needs as they arise. You do not have to be a tax expert! Here’s what you can do to support survivors with tax filing.

Provide basic tax education. Many survivors may be overwhelmed or scared to file taxes. Share the benefits of tax filing and how it may help them achieve longer-term goals such as creating an emergency fund, purchasing a car, homeownership, or higher education. Reassure survivors if they don’t get a tax refund (or if it isn’t the size they expected).

While some people only want to file taxes if they know they will get a big refund, tax laws can change, along with eligibility for tax credits. If someone doesn’t get a sizeable refund when they file their taxes this year, they may get a larger refund in the future. Additionally, many Americans view tax filing as a civic duty to fulfill that has value beyond a tax refund.

Partner with tax professionals. Identify your local free tax filing sites and tax professionals that specialize in tax matters related to domestic violence survivors. Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) are IRS-sponsored programs. In addition to taking an annual certification exam, volunteers are bound by federal confidentiality rules when helping tax filers.

Find free tax preparation sites in your area using the IRS Site Locator Tool. Check out the requirements for your local sites before sharing with survivors. For example, some VITA sites require appointments while others only accept walk-ins. If you cannot find a free tax site near you, share with survivors these eight steps to find a paid tax preparer.

For help with managing joint tax liability and other complex tax matters, direct survivors to your area Taxpayer Advocate Service (TAS) office or Low-Income Taxpayer Clinic (LITC). Both TAS offices and LITCs help taxpayers resolve problems with the IRS. Some LITCs may provide other legal support. Legal Aid is another resource that can help survivors with legal matters.

Share resources. In addition to directing survivors to free tax sites and specialized tax help, you can also share tax filing information to assist with specific needs. Below are some useful resources.

Missing Tax Documents

Prior Year Tax Returns - A transcript of a prior year tax return may provide all necessary information for some to file taxes. One can get a tax transcript from the IRS for free by submitting Form 4506-T, “Request for Transcript of Tax Return,” to the IRS. Most requests are processed within ten business days. There are three types of transcripts:

- Tax Return Transcript: Provides line item information from an original tax return along with any forms or schedules submitted. This information is sufficient in most cases to file one’s taxes.

- Tax Account Transcript: Supplies details such as marital status, type of return filed, adjusted gross income (AGI), taxable income, and any adjustments made to the return after submission.

- Record of Account: Combines the Tax Return and Tax Account Transcripts to present the most detailed information.

If a photocopy of a tax return (with all attachments including W-2 forms) is needed, use Form 4506, “Request for Copy of Tax Return.” Since this option costs $50, it is best to first see if a transcript can be used. Copies of tax returns can take up to 75 calendar days to process.

Wage Information - If information about wages and taxes withheld is missing, one can complete Form 4852, “Substitute for Form W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, and Insurance Contracts, etc.” It is helpful if survivors have earnings documentation, such as a final pay stub, when completing this form. If documentation is not available, survivors may still be able to complete the form by estimating their earnings. If needed, a local free tax preparation site may be able to provide guidance on how to do this.

Alternative Mailing Address

Alternative Mailing Address

Address Confidentiality Programs (ACP) are operated by the Secretary of State’s office or another local agency and may provide survivors with a substitute mailing address and mail forwarding services. All states do not offer ACP, so visit www.USA.gov and enter “address confidentiality program” plus your state in the search box to see if the program exists where you are located.

Financial Safety Planning

The Financial Clinic compiled Financial Safety Planning Best Practices for Domestic Violence Service Providers. The guide outlines useful screening questions advocates can ask survivors and suggested next steps they can take depending on whether survivors live with an abuser or alone.

Gig Economy Workers

Some survivors may turn to gig work as a quick way to earn income, especially if they’ve experienced a lapse in employment. While gig work offers flexible hours, a low barrier to entry, and immediate work, filing taxes from such work can be complex. The Center on Budget and Policy Priorities’ Get It Back Campaign offers an online Estimated Self-Employment Tax Payments Calculator to help self-employed workers understand how much they need to pay in taxes through the year.

Rideshare driving (Uber, Lyft, etc.) is one of the most popular types of gig work. Since tax preparation for rideshare drivers can be difficult to navigate, the Get It Back Campaign and CASH Campaign of Maryland created Roadmap to Rideshare Taxes, a comprehensive tax resource, to support this population. This resource covers tricky topics such as: how self-employment taxes work, counting income, tracking tax deductions for business expenses, and making quarterly estimated tax payments.

Additional Information

- IRS’ Survivors of Domestic Abuse FAQs: “Domestic abuse is not just physical abuse. It often includes economic control. As a survivor of domestic abuse, you can take control of your finances. An important part of managing your finances is understanding your tax rights and responsibilities.” This document by the Internal Revenue Service offers tax information for survivors of domestic violence, including a brief overview of taxpayers’ rights and responsibilities.

- Special Collection: Earned Income Tax Credit (EITC) and Other Tax Credits: This collection highlights key resources for the EITC, the Child Tax Credit, health coverage tax credits, and others. It includes general information and fact sheets, reports and research, information about how tax credits affect eligibility for other federal benefits, resources to access state-specific statistics and contact information, and resources specific to four underserved populations (domestic violence survivors, Native Americans, workers who are immigrants, and workers with disabilities). It also provides information on free tax preparation services across the country and ways to avoid predatory lending and tax services.

- Center on Budget and Policy Priorities (CBPP): CBPP is a nonpartisan research and policy institute, pursuing federal and state policies designed both to reduce poverty and inequality and to restore fiscal responsibility in equitable and effective ways. CBPP applies extensive understanding of budget and tax issues and in programs and policies that help low-income people in order to help inform debates and achieve better policy outcomes.