Many social justice advocates, organizations and policy makers across the United States are concerned with increasing the economic stability of underserved and marginalized populations. Numerous strategies are utilized towards this end, including tax credit and deduction programs. Resources here include tax preparation services, research on how to increase access to tax credit programs, and specific tax codes relevant to Native Americans, workers who are immigrants, and workers with disabilities. There are also helpful resources to address the concerns of domestic violence survivors in the tax filing process.

"It is especially important for outreach messages to emphasize that immigrants who are legally authorized to work and have Social Security numbers (SSNs) may be eligible for the EITC, and that families may qualify for the CTC even if all family members do not yet have SSNs.” ~ National EITC Outreach Campaign of the Center on Budget and Policy Priorities

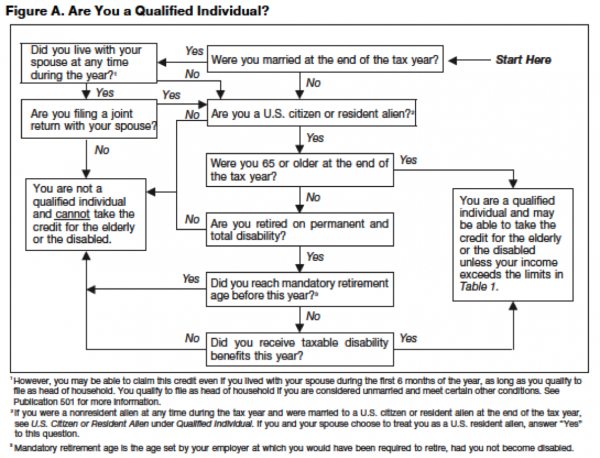

Graphic from "Publication 524: Credit for the Elderly or the Disabled" (Internal Revenue Service)